Blog

How can you build your business resilience in these tough times?

How to build resilience so that your business survives and thrives!

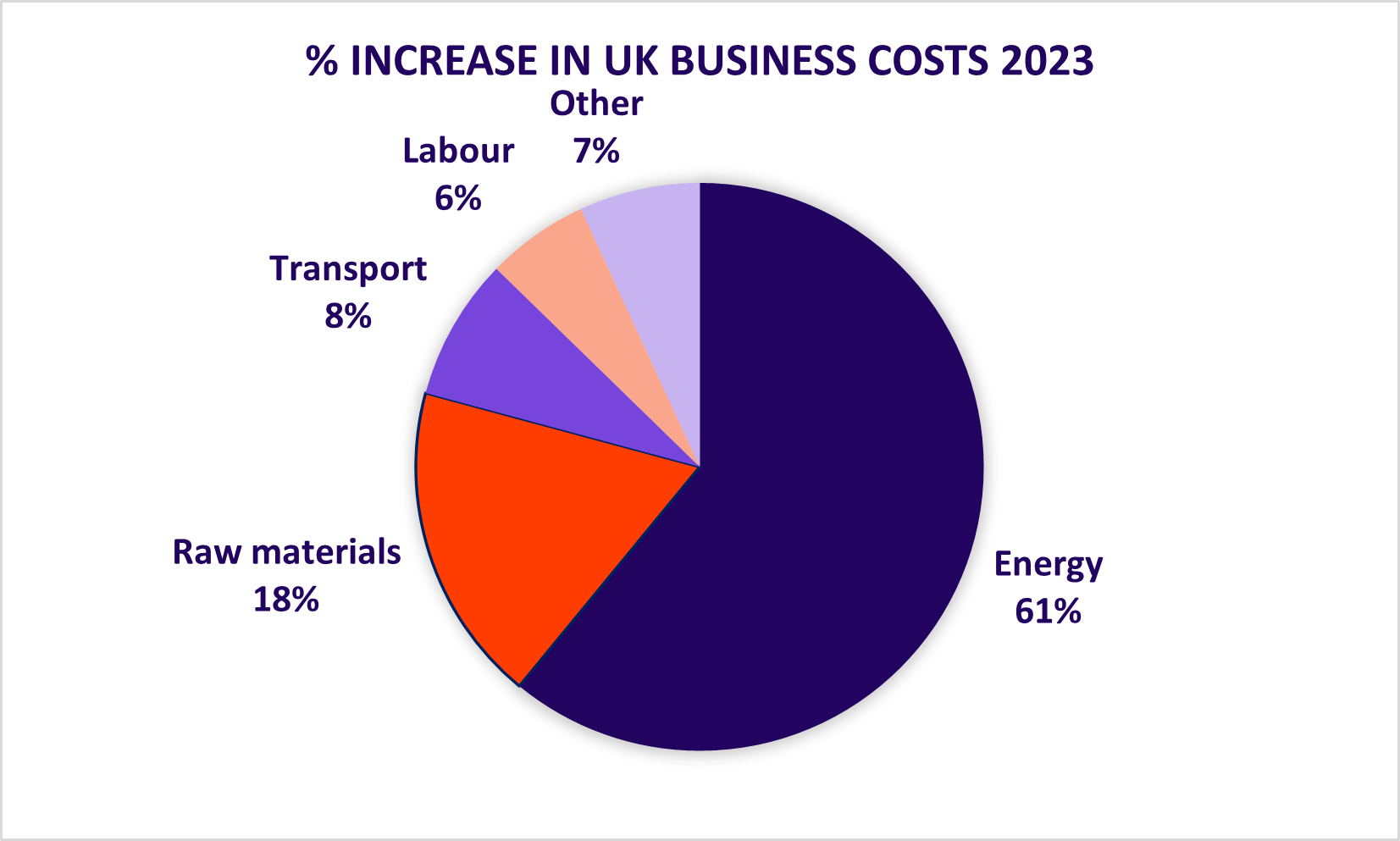

Increasing UK business costs in 2023 have impacted profits and growth

According to the Office for National Statistics (ONS), the cost of goods and services bought by businesses in the UK increased by 19.2% in the 12 months to September 2023. This is the highest rate of inflation for business costs since records began in 1997. The biggest drivers of costs increase are still energy costs with prices seeing a rise of 99.3% over the 12 months. Energy prices are still rising due to ongoing supply shortages as a result of the Ukraine War and global demand upsurge following the Covid pandemic. In the UK cost rises have been exasperated by the weak pound against the dollar making buying energy from the global market more expensive, and the UK reliance on natural gas as it transitions to renewable energies making the UK market more exposed to global natural gas price fluctuations.

Other significant cost increases in the UK included raw materials (29.7%), transport (13.2%), and labour (9.5%), with upward pressure from high UK interest rates, a weak £, global inflation, and increasing demand and limited supply, all playing their part.

The relative impact of rising costs on individual businesses will depend on the nature of their business and market sector. For example, manufacturing businesses have been particularly hit hard by the rise in raw material and energy costs but service sectors have struggled more with the increases in labour costs.

It doesn't look like the pressure from increasing costs on UK business will end anytime soon. The ONS also found that businesses in the UK expect their costs to continue to rise in the coming months. Around two-thirds of businesses expect their costs to rise in the 12 months to September 2024.

What is the impact on profits and growth?

According to a recent survey by the Confederation of British Industry (CBI), 60% of businesses in the UK are reporting a decline in profits due to rising costs with 75% of businesses expecting their costs to continue to rise in the coming months. The impact on employment is negative with the Institute of Chartered Accountants in England and Wales (ICAEW) finding that 60% of businesses in the UK are planning to cut jobs due to rising costs. Overall the cost pressures on business are already impacting business profits and by extension this will inevitably lead to a fall in growth as consumer and business demand falls and investment is cut.

What about business failures?

In the past 12 months (to September 2023), 585,807 businesses failed in the UK, a year-on-year increase of 0.7%. This means that an average of 1,600 businesses closed down every day.

Is it all doom and gloom or can you make changes in your business now and plan forward, to mitigate economic pressures?

Wood and Disney understand what it’s like to face the pressures of running a business, the worry, the sleepless nights, the feeling of being alone and not sure of the best course of action, working all hours. Working to provide a better future for yourself and those that are important to you. We’ve been there and done it. We’ve made mistakes and learnt from them. We’ve survived through the early 1990’s recession (inflation peaked at 9.5% in 1990, with interest rates hitting a high of 14.8% on Black Wednesday), the 2008 recession (the deepest UK recession since WWII) and the Covid-19 pandemic. We use our experience of running our own businesses and helping our clients through the good times and bad, to make sure that the advice we give you is practical and works so that your business is resilient and thrives.

Some of our clients have been with us for over 30 years although they may be a little greyer and more wrinkled now. So it's not all doom and gloom - you can build resilience into your business, ride out the storms and emerge stronger. Our experience is that business owners are a resilient group and those that are the most successful are also flexible in their planning.

Protect your business today and put in place protection for tomorrow.

Security Today ~ Wood and Disney ring fence assets that you have already acquired. To limit today’s risks; what you could lose if things go wrong both from a personal point of view and for your business.

Security in the Future ~ Wood and Disney think ahead to future risks. We identify and make sure you have in place business and financial structures, insurances and the right legal frameworks to protect your personal and business assets if the unexpected happens in the future.

Financial Resilience

Financial Management

Wood and Disney make sure that you have the right financial management systems and controls in place so that you know and understand exactly what is going on in your business and have up to date data to control your business and take action to avoid and mitigate problems and plan for a secure future.

Wood and Disney ensure you have:

- Management accounts:

accurate and timely management accounts are essential to plan better and make better decisions. You will spot opportunities sooner and stop negative actions faster leading to a stronger business.

- Budgets: Review your Budgets and set realistic and achievable targets for the remainder of 2023 and know your cash flow forecast inside out.

- Key Performance Indicators: Establish and understand your key performance indicators (KPI’s) and measure them on a weekly basis.

- Control Costs - Bottom up budgeting: Look at your expenses and see if you can make small cut backs in lots of areas. Use ‘bottom up’ budgeting where everyone in the office gives input on areas over which they have control – target a 10% cost saving.

- Know what you are spending and on what: Look at your detailed expense list in your profit and loss account and assess if there is room for negotiation in any of your fixed expenses and whether there are alternative suppliers. Be careful to consider the affect of changing suppliers on both your team and on your customers before just hacking away at costs.

Cash Flows

You need both short term cash flow solutions to get the money coming into your business today, tomorrow and over the coming days and weeks PLUS you need long term cash flow solutions to build cash reserves in your business to keep you out of trouble in the future.

Wood and Disney provide both short and long term cash management systems and solutions. Find out more on our dedicated web page:

>> Cash flow solutions for today

>> Building a cash reserve ~ Strategic Cash Retention Programme

Some of the actions we have advised our clients to do recently to firm up their cash flow in these tough times, include:

- Credit control:

- Assign responsibility to one individual for invoicing and collections.

- Make sure your terms of business contain explicit payment terms.

- Review debtors list and chase up overdue invoices (if appropriate). If applicable, offer existing debtors extended payment terms and/or discounts.

- Get rid of “Won’t Pay” customers.

Risk Reduction

Over-reliance on a single product, supplier or customer can expose a business to cash flow risks.

- Diversifying revenue streams by expanding into new markets, launching new products, or targeting additional customer segments can help mitigate the impact of fluctuations in a single area of the business.

- The same applies to suppliers. If you are dependent on a single supplier they will command pricing and delivery. By finding additional suppliers even if they charge a little more initially helps you should the supply market be affected by external influences.

The whole idea of risk reduction is to consider these dependencies and look for opportunities to build stability and longevity

Processes and Systems

Creating Business Systems is the only way to achieve results that are consistent, measurable and resilient. Wood and Disney identify each and every process in your business and turn it into a system. Having effective business systems is the only practical way to manage the important details of your operation.

Some of the actions

Wood and Disney have advised our clients to do recently to improve their systems and processes, include:

- Review and flow chart the main processes in a business (e.g. Sales processing, order fulfillment, shipping etc) and challenge the need for each step.

- Reviewing lists of products and services and eliminate those that are unprofitable or not core products/services.

- Outsourcing: Reviewing efficiency of business processes and considering alternatives such as outsourcing certain activities locally or overseas.

Relationships with stakeholders

Building strong relationships with stakeholders is important can be mutually beneficial. Business credibility is particularly important when you are building relationships; it is about being trusted and believed in. Credibility gives employees, suppliers, investors and your customers confidence that you will fulfill your promises. Wood and Disney have a blog dedicated to how to build credibility in your business:

>> Credibility - why is it so important?

Wood and Disney have recently helped our clients to build resilience into their businesses by:

- Customers: Put extra effort into making sure your relationships with your customers is strong. It is much easier to grow business with an existing customer whether that is adding sales value to existing products and services bought, cross selling, or gaining referrals than finding and starting afresh with a new customer.

- Banks and lenders: If appropriate, review banking facilities and discuss future needs. Build personal relationships with your bank manager and other financial stakeholders. Building goodwill now will help to gander a more positive attitude to your business in the future.

- Don't ignore debt. Ask for help if you are struggling.

- Suppliers: Build positive relationships with suppliers, particularly those that are critical to your business.

- Negotiate. Engage in proactive communication with suppliers to negotiate more favourable payment terms. Request extended payment periods or explore vendor financing options.

- Avoid becoming dependent on one key supplier.

Your People

In most businesses your team are your biggest asset. Wood and Disney talk to you and your team and develop an action plan to equip your business with the people and skills it needs to adapt, change and deliver resilience. We also look at the knowledge, skills and experience you have built up in your team and work with you and them to leverage that human asset to build a stronger business that is mutually beneficial by rewarding staff and security into the future.

Advice we have given most recently to clients includes:

- Involve members of staff in a discussion of likely trading conditions and get their input on maintaining revenues, new products and services or re-targeting existing products and services.

- Encourage team members to suggest ways to streamline and simplify processes (e.g. sit down and brainstorm about efficiencies and cost reduction).

- Reviewing staffing needs over the next few months.

- Employee commitment: Pull everyone together and explain the business strategy and get their buy-in.

It's NOT all doom and gloom!

Your business can survive and thrive despite the maelstrom of economic bad news that seem to hit us every day. If you have in place ...

- the right Protection

- Financial management

- Controls and Processes

- Strong relationships

- the right People

Wood and Disney have a proven track record of helping our clients weather the storms of business life and we will be there for you.

Please talk to us about planning ahead because we have considerable experience with helping our clients with their strategy and sustainability in turbulent times.

You can get in touch by calling: 01206 233170

Or by completing the message form and we'll get back to you.