Frequently asked questions

Ever wanted to know....

At Wood and Disney we are always out and about talking to business people about their businesses, problems and successes. Some contact us as prospective new clients, asking about the services we provide and how we can help them. We meet many business owners at networking events, exhibitions and conferences. There are quite a few questions that many people ask us. We've listed a few below and the answers we give. Don't forget that you and your business are unique, so it's not a one size fits all situation.

Just click on the bullet point to go straight to our answer!

Can't see your question not on the list?

If we haven't addressed a question you want answered or you just need more information considering your individual circumstances, just fill in the quick response form below and we'll get back to you.

What is Making Tax Digital?

What software should I use to comply with Making Tax Digital?

Why do I need an accountant if my accounting software does everything for me?

Why does an accountant need to check my bookkeeper's work?

- “Can’t see the wood for the trees” - Bookkeepers are responsible for recording financial transactions, categorising expenses, and basically keeping financial records up to date. However, like any human task errors can occur simply because the bookkeeper is so close to the task that they can easily miss something obvious. Accountants are trained to spot discrepancies, anomalies, or inaccuracies in your records that might otherwise go unnoticed by your bookkeeper. This is not a criticism but simply human nature. Qualified accountants, such as Wood and Disney, come to the numbers fresh and unbiased, and our meticulous review ensures that your financial data remains accurate and reliable.

- The law - Tax laws, accounting standards, and financial regulations are constantly changing. Staying updated with these changes can be overwhelming for a business owner or their bookkeeper. Accountants, however, are required to undertake annual training and updates to ensure they understand these evolving rules. They can therefore verify that your financial records adhere to the latest regulatory requirements, reducing your risk of non-compliance and potential legal issues. For example, we are constantly finding that VAT is being claimed on expenses that do not have VAT on them such as insurance, bank charges and interest, customer entertaining, rates and water bills and even on dividends and other private expenses. Errors such as this not only impact on VAT but also on income or corporation tax so get this wrong and you will have penalties and interest from multiple tax departments.

- Reliance on technology - Yes we all know that Xero and QuickBooks use AI and machine learning to reduce human error and will replace us eventually BUT….it’s not there yet and with machine learning it can learn the wrong things too. We have noticed increasing reliance by bookkeepers on technology and they are assuming it is getting it right but that is not a safe assumption. We saw a case recently where the bookkeeper filed the tax returns without a third-party accountant checking what they did. A monthly dividend of £4,000 was posted by mistake to Cost of Sales and the system replicated that transaction for a further 4 months resulting in underpaid Corporation Tax and underpaid income tax because the lower dividend had been put onto the business owner’s tax return. The business owner suffered penalties and interest as a result. Here at Wood and Disney, we love technology but are also well aware of its inadequacies so continue to apply vigorous checks to ensure accuracy.

- Unusual transactions - Bookkeepers are great with repetitive transactions. Everyday sales invoices and bills are nice and easy. Matching payments and receipts generally is straightforward. Then an unusual transaction occurs such as a sale of a motor vehicle where we find the sales invoice is simply included in general sales in the profit and loss account. The asset has not been removed from the balance sheet making the accounts wrong. It is made even worse if the vehicle sold had an outstanding Hire purchase liability, so the amount received is less than the actual sales value. An opportunity for a Vat and tax problem. We also see assets purchased on finance being processed through the purchase ledger and each month’s repayment being deducted from the original invoice with no record of the HP interest being paid. Unusual transactions happen more often than you would expect and are often recorded incorrectly. Here at Wood and Disney we are rigorously trained and understand how these transactions should be processed to ensure the correct tax liabilities are declared and of course the correct tax claims are made.

- Cost Savings - Accountants bring a different perspective to your financial data. By scrutinising your books, they can identify cost-saving opportunities that may have been overlooked. They may suggest optimising expenses, finding additional tax deductions, or streamlining financial processes, all of which contribute to improved profitability. At Wood and Disney we have systems to identify which costs should be reviewed based upon their impacts on both your team and your customers.

- Detecting Fraud and Irregularities - Financial fraud can have devastating consequences for a business to the extent that business have gone into liquidation as a result of fraud. While bookkeepers focus on recording transactions, accountants take a broader view of the financial landscape. This perspective allows them to more likely spot irregularities or red flags that may indicate fraudulent activities. Their vigilance can help safeguard your business against serious financial misconduct. At Wood and Disney, one of our directors spent some time seconded to fraud squad and therefore has a unique perspective on the indicators of fraud.

- Providing Financial Insights - Qualified accountants are trained to analyse financial data and extract meaningful insights. They can create comprehensive financial reports, forecasts, and budgets based on the data provided by bookkeepers. These insights are invaluable for making informed decisions, setting strategic goals, and identifying areas for growth and improvement. Whereas bookkeepers are the processors of disorganised data into structured records, accountants are the translators of those records into something understandable. Wood and Disney do this with both images and language so that our clients gain greater financial knowledge and understanding leading to better decisions and greater wealth.

- Enhancing Financial Transparency - Transparent financial records are crucial for building trust with stakeholders, including investors, lenders, and external shareholders. When accountants review a bookkeeper's work, they ensure that the financial statements are presented clearly and accurately, promoting understanding and confidence by important third parties resulting in faster lending decisions at lower rates or more beneficial investment decisions by potential investors or a better sales price if you are looking to sell.

- Better Business Planning - Whether you're planning to expand, secure financing, or make strategic investments, having a qualified accountant review your financial records is essential. They can provide valuable recommendations and financial projections to guide your decision-making process, increasing the likelihood of success in your business endeavours. Wood and Disney provide cash flow planning, management accounts, strategic planning services and many more forward looking services.

- Finally - In the world of finance, the collaboration between bookkeepers and accountants is a symbiotic relationship that ensures the financial health and success of a business. While bookkeepers are responsible for the day-to-day recording of transactions, accountants play a pivotal role in reviewing their work to ensure accuracy, compliance, and financial integrity. By leveraging the expertise of both professionals, businesses can make informed decisions, navigate complex financial landscapes, and ultimately thrive in a competitive market. And yes Wood and Disney do provide bookkeeping services but we have very strict checking and review processes so we do not become complacent because we accept that “the buck stops with us” and if we make a mistake we pay any interest and penalties.

How can an accountant help my business to grow?

- Wood and Disney can help you develop a financial plan for your business, including setting goals, budgeting and forecasting. We can also help you make informed decisions about where your business is going, its finances, its needs such as borrowing or raising investment and advice about when to expand, hire new team members, or invest in new plant and equipment.

- Growth must be based upon a firm foundation so Wood and Disney can help you ensure that your business is compliant with all applicable tax laws. This will save you time by avoiding distractions, and money by avoiding penalties and interest.

- Wood and Disney can review your financial records to ensure that they are accurate and complete. This can help to identify any areas where you may be overpaying tax or making other financial mistakes.

- Growth is not just about sales but also about controlling your costs as you expand. Wood and Disney can help you to identify areas where you can save money in your business and not just by selecting the largest costs in your Profit and Loss Account and suggesting cuts but to assess the impact of any cuts on customers and your team. We can also help in negotiating better deals with suppliers, streamlining operations, or assessing unnecessary expenses.

- As accountants Wood and Disney can help you track your business's cash flow, which is essential for ensuring that you have enough money to cover your expenses. We can also help you develop a cash flow forecast to help you plan for future cash requirements.

- Wood and Disney can prepare management accounts as well as year-end financial statements for your business, such as income statements, variance analysis, balance sheets and cash flow statements. These statements can be used to track your business's financial performance and help you make better business decisions.

- Wood and Disney can advise you on investment opportunities that may be right for your business. This may include helping you develop an investment strategy, such as acquiring other complimentary businesses or by working alongside an IFA help you invest your surplus cash to ensure it works hard for you.

- As Chartered Accountants Wood and Disney can help you determine the true value of your business. This may be needed if you are considering selling your business, passing shares onto your management team or perhaps if you are seeking finance.

- Wood and Disney can help you develop a succession plan for your business. This plan will outline how your business will be transferred to the next generation rather than being sold to a third party.

- As Chartered Accountants Wood and Disney can help you navigate the complex financial and legal aspects of mergers and acquisitions. This may include helping you value a target company, advising on negotiate the terms of the deal, and supporting you to complete the transaction.

How do accountants determine what they charge?

- The type of services being provided: Some accounting services are more complex and time-consuming than others, and therefore command higher fees. For example, tax preparation and business advice are typically more expensive than bookkeeping which is being replaced by Ai.

- The size and complexity of the client's business: Larger and more complex businesses typically require more extensive accounting services, and therefore pay higher fees.

- The accountant's experience and expertise: The greater the knowledge and experience the higher the fees.

- The location of the accountant: Some very small accountants are working fully from home or even overseas and do not see the benefit of an office location, preferring never to meet in person. In our view this prevents them from not only not properly supporting their clients but also their teams if they have any have no relationship with their clients and simply treat their jobs as a production line. Those accountants who prefer an office do so to build a team culture, improve training and as a result do a better job for their clients. The downside is they have greater costs which they have to pass on to their clients.

- Ongoing education: As chartered accountants Wood & Disney are monitored by the ICAEW to ensure that we maintain our knowledge, so we are up to date with the latest changes in taxes or legislation which of course benefits our clients.

- Using an hourly rate: This is the most common method of charging for accounting services. Accountants typically charge a set rate per hour, depending on the seniority and experience of the person doing the job. The major downside of using an hourly rate is that it encourages spending more time on a job resulting in higher fees for the client.

- Percentage of revenue: This method involves charging a percentage of the client's annual revenue. This method is often used for auditing and consulting services but means that the same fee can be paid by a business with thousands of low value sales invoices compared to another which has a small number of very high value sales invoices. This doesn’t fairly reflect the work involved.

- Retainer: This method involves charging a monthly fee for ongoing accounting services. Retainer fees are often used for businesses that require a high level of support from their accountant.

- Fixed fee: This method involves charging a set fee for a specific service, regardless of how long it takes to complete. Fixed fees put the onerous on the accountant to find efficiencies including better technology in order to make a profit.

Why do accountancy fees vary so much?

How often should I meet with my accountant?

How can I find a trustworthy accountant?

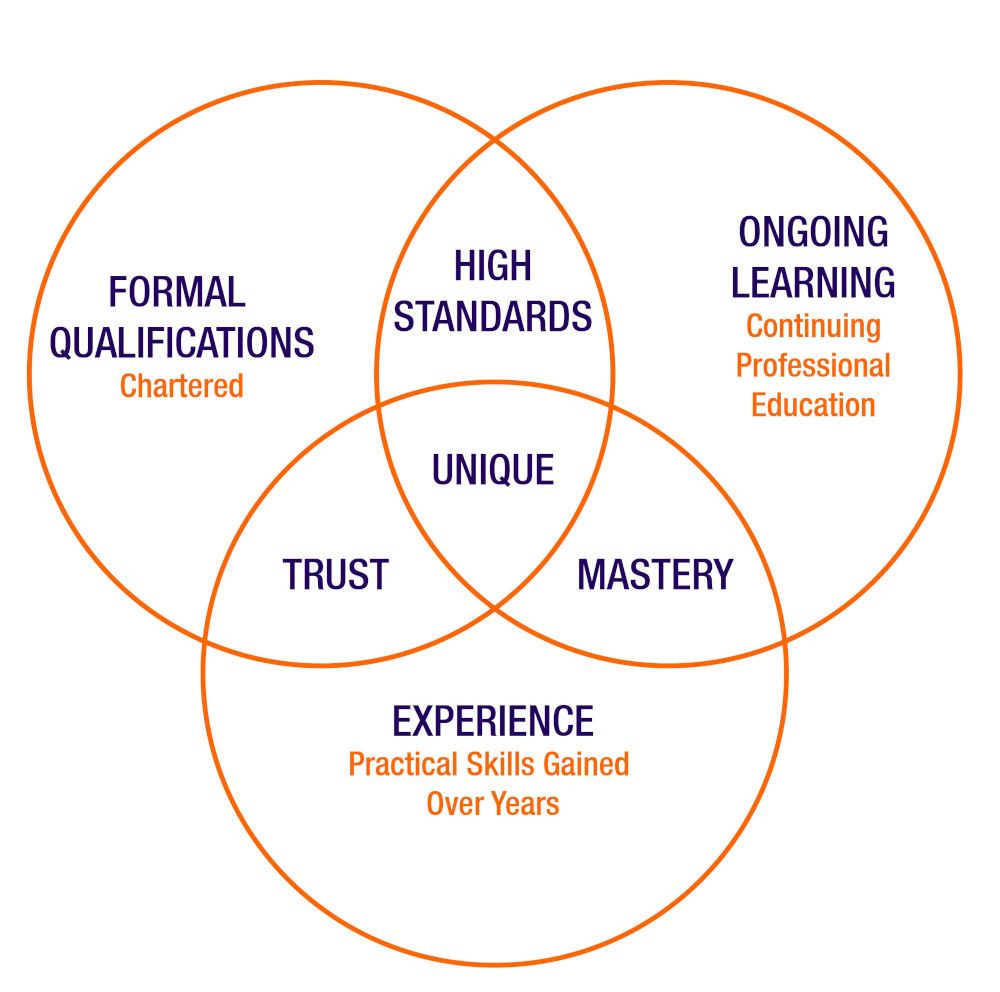

Aren’t all accountants the same?

- qualifications,

- ongoing formal learning and

- their very specific practical experience.

How do I know if my accountant is qualified?

What questions should I ask when hiring an accountant?

- What are your qualifications? Ideally, they should be regulated by one of the Chartered Institutes, so you are looking for ACA or FCA who are members of the ICAEW, ACCA or FCCA who are members of the ACCA and finally ACMA or FCMA who are members of CIMA.

- How long have you been an accountant? Passing exams is only part of the equation and practical experience is also essential so asking how long they have been in practice is a key guide. The word practice shows that they have been working with clients just like you whereas many accountants choose to work in industry, perhaps in a finance department of a major PLC. Although they may understand debits and credits, what do they really know about a small or medium business and they certainly don’t have any tax knowledge. Also, if they have been in practice for a long time they will have seen success and failure and understand why each occurs. This business experience (rather than just financial experience) can be extremely valuable for a small or medium business.

- Do you have any other clients in my industry? Be careful with this one because although having some experience in your industry could be useful particularly if there are unusual tax considerations it doesn’t necessarily help if you are looking for business advice. The reason for this is that the “specialist” is also giving the same advice to all of your competitors. And for the specialist they are not gaining any new knowledge from different industry experiences. In an ideal world Wood & Disney would prefer to have one client from every type of business so we can cross pollinate ideas to increase success for all of our clients. In reality, we have pockets of clients in similar industries as well as a wide spectrum of different industries. We prefer not to have an industry specialisation and instead have a business advisory specialisation.

- Do you have experience of a particular financial need? You are about to sell a property and you know you have to pay capital gains tax but need some help. Not all accountants deal with Capital Gains Tax so you need to ask a specific question to ensure the accountant you select can deal with that issue. You are going through a divorce and need a business valuation? Again not every accountant can deal with this. By the way Wood and Disney have experience of both of these scenarios.

- What other services do you offer? Some accountants are just bookkeeper accountants. They process your transactions based upon what you tell them and they produce your historical accounts based upon those transactions just to be able to prepare a tax return. They offer no tax or business advice and that may be fine. If your business is very small and very simple then perhaps that’s all you need. As chartered accountants Wood and Disney offer a wide variety of services covering all aspects of tax as well as business growth and profitability advice.

- How do I know you are up to date in changes in tax and regulation? As chartered accountants Wood and Disney are strictly regulated by the ICAEW and as such we have to comply with their requirements to attend seminars and webinars throughout the year. In fact, we are part of 2020 Innovation who provide monthly webinars on tax and regulation as well as two annual conferences which we attend. We apply the philosophy that “if you stop learning you stop earning” so are keen to maintain not only our knowledge of tax and accounts but also of new technology affecting the accountancy profession.

- If I have a question how quickly will you respond? If you have chosen a “one man band” who works from home then you are not going to get a very fast answer to any questions and no answers when that person is on holiday. The vast majority of your questions will not require a high-level technical answer so using a firm of accountants like Wood & Disney means that responses are faster because it is likely that multiple people in the office can answer that question. If it is a high-level technical question then yes of course it may take longer to respond depending on other tasks and appointments, however at Wood and Disney our target is to respond the same day or at the worst the following working day.

- How do you protect my sensitive financial data? Obviously, your data is extremely sensitive and you don’t want other people to know about your wealth. Complying with data protection and being compliant with GDPR would be the very minimum you would expect. It is surprising how many accountants do not comply so you can check online at https://ico.org.uk/ESDWebPages/Search. If you know the registration number then use that but otherwise the system can search on name, address and postcode. For your information our registration number is Z5296040 and we have been registered since our business was incorporated in 2001. On top of this Wood and Disney went though the process of gaining ISO 27001 for information security management. Sadly it proved to be very expensive for a small business such as ours and we did not renew in 2020 but the systems and processes we put into place are still being used. For example, all accounts and tax returns are sent to our clients via our secure portal called Citrix Sharefile to ensure such sensitive information can only be accessed by the right person. We have no paper files in our office as everything is in the cloud. Any post is scanned and shredded. All desks are cleared at night, everything is locked and we have a key safe. All of our laptops are encrypted. Finally, all members of staff sign confidentiality letters every year.

Why do I need a firm of accountants when a single accountant working from home is cheaper?

What happens if I discover I have appointed the wrong accountant?

Not found the answer to your question?

Are you thinking of changing your accountant?

Find out if your current accountant is up to the standards of the best accountants; adding value to your business by supporting you with business advice, strategic planning and leveraging technology to give you a competitive edge. Helping you build a resilient, growing business on course for sustainable success. Or are they holding you back?

Take our 5 minute test and find out how they measure up

Take the test